Burford Capital

Sustainability Report and Carbon Intensity Rankings

Is Burford Capital doing their part?

Their DitchCarbon score is 30

Burford Capital has a DitchCarbon Score of 30 out of 100, indicating a lower performance in sustainability measures. This score suggests that the company has a relatively high carbon intensity compared to more sustainable peers. Efforts to reduce emissions and improve sustainability practices are necessary for Burford Capital to increase its score.

This was calculated based on 30+ company specific emissions data points, the higher the score, the better. Check out our methodology.

Industry emissions intensity

Very low

Low

Medium

High

Very high

Burford Capital is part of the finance sector, which has a very low carbon intensity ranking compared to other industries. Some industries are more damaging than others, this ranking gives you an indication of how carbon intensive the industry is which this company operates in.

Location emissions intensity

Very low

Low

Medium

High

Very high

Burford Capital, located in the United States, benefits from the country’s low carbon intensity rating, which positively influences the company’s sustainability profile. Operating in a region with a lower carbon footprint aids in reducing the overall environmental impact of their business activities.

20.83%

...this company is doing 20.83% worse in emissions than the industry average.

Founded in 2009, Burford Capital is a prominent player in the US finance sector, specializing in legal finance and investment management. Headquartered in New York, with key offices in London and Chicago, the company offers services such as litigation finance, risk management, and asset recovery. As a publicly traded entity on the London Stock Exchange, Burford Capital serves a global clientele, partnering with law firms and clients internationally.

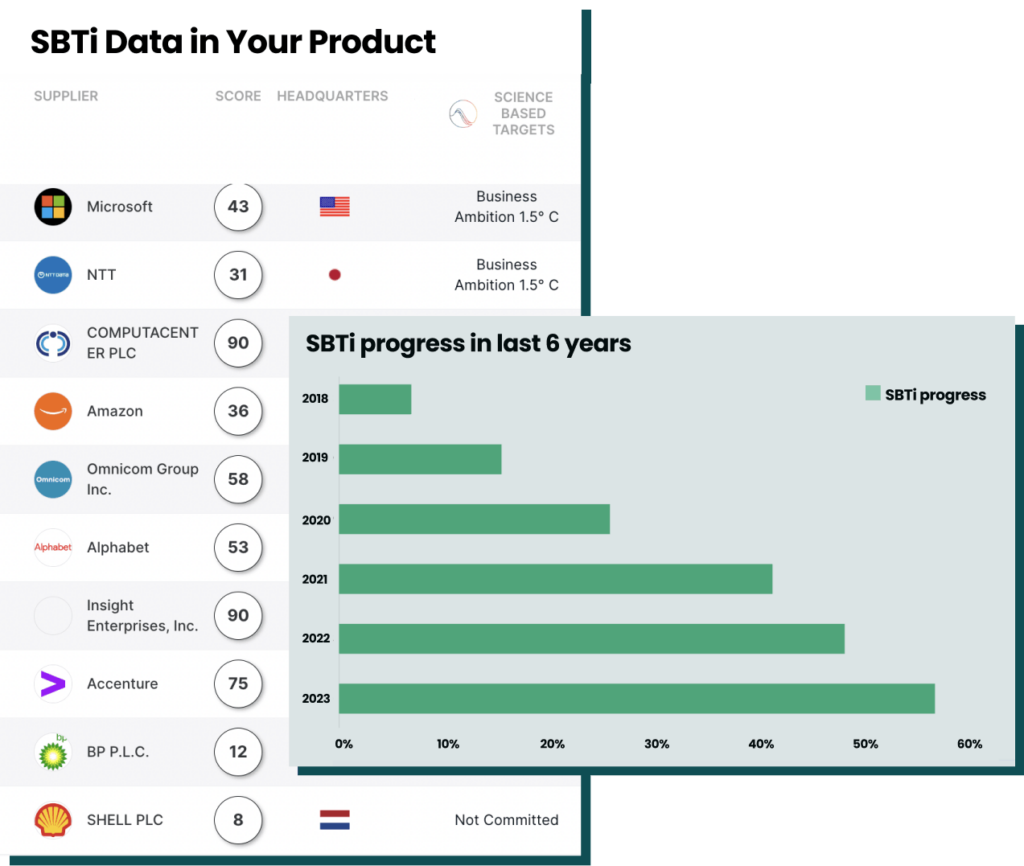

Bad news, Burford Capital hasn't committed to SBTi goals yet

Burford Capital has not yet established specific commitments with the Science Based Targets initiative (SBTi). This means the company has not publicly outlined or committed to concrete targets for reducing its greenhouse gas emissions in line with climate science.

There’s always room for improvement,

DitchCarbon recommends...

Not participating

Get unlimited free access to SBTI data via API

Reduce emissions with actionable insights on all your suppliers, embedded seamlessly into your procurement stack

Case study — How Compleat's clients use our carbon data

Making Compleat’s customers climate heroes. Download the 19-page case study PDF.

Claim this profile

Are you associate with this company?

Help us improve our data and claim this profile.

Our methodology

Read about our emission calculation methodologies, and what the DitchCarbon Score means.