Uncovering Corporate Sustainability Reporting Directive (CSRD)

The European Union (EU) regulations mandate a new ESG reporting and large companies to report on social and environmental risks and impacts.

In this guide, we’ll explore the intricacies of Corporate Sustainability Reporting Directive, its disclosures, disclosure requirements, and benefits of implementing it.

From understanding its reporting landscape and requirements to examining its potential to drive positive change in businesses, this article will equip you with the knowledge to navigate this new era of corporate sustainability compliance.

What is CSRD?

Since its passing in July 2024 by the European Commission, Corporate Sustainability Reporting Directive (CSRD) is a new EU mandatory reporting that requires both large and small companies to establish due diligence strategies on human rights and environmental issues, thereby taking responsibility for their negative impacts.

Being a part of the EU’s broader Sustainable Finance Package and EU Taxonomy, CSRD aims to help improve capital cash flows towards sustainable activities.

It addresses the longstanding issue of incomplete non-financial reporting directive. Their report needs to be supported by audited sustainability information.

It brings sustainability closer to financial reporting.

This means that there are significant implications for the data that needs to be disclosed, how that information is collected and the processes that need to be in place to meet its requirements.

Who will need to comply with the CSRD?

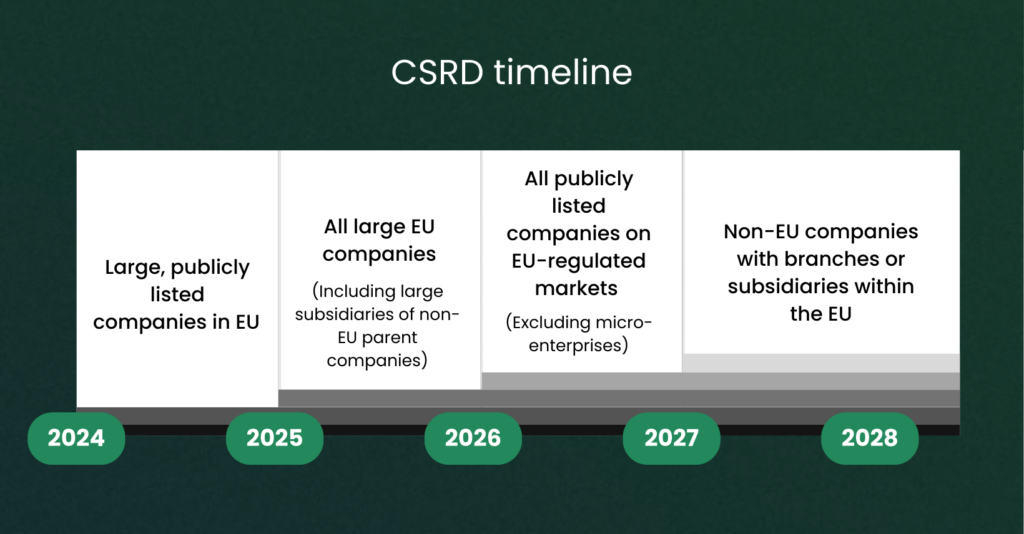

The Corporate Sustainability Reporting Directive (CSRD) employs a gradual rollout strategy for sustainability disclosure requirements.

Over the next five years, growing number of organizations, totaling nearly 49,000 both within and outside the EU, will be obligated to comply with CSRD regulations.

The initial wave of reporting is set to begin in 2025, with large, publicly listed EU companies currently adhering to the Non-Financial Reporting Directive (NFRD) leading the way.

Each reporting cycle will require organizations to present data from the preceding year. For instance, those mandated to start reporting in 2025 will need to disclose information from 2024.

So, it’s important to start your data collection processes well in advance, ideally at least one year before their reporting obligations commence.

This proactive approach ensures that companies are well-prepared to meet the CSRD’s comprehensive requirements.

What are the reporting requirements under CSRD?

The CSRD works in tandem with the European Sustainability Reporting Standards (ESRS) to establish a comprehensive reporting framework.

While CSRD reporting sets out who are required to report and when, the ESRS outlines what to report.

Under this framework, organizations are mandated to incorporate their ESRS-aligned disclosures within their annual management reports

This integration ensures that sustainability information is presented alongside financial data, offering stakeholders a holistic view of the company’s performance and impact.

A key aspect of this reporting mechanism is the requirement for reasonable assurance on the disclosed information, elevating the credibility and reliability to a level comparable with financial reporting standards.

The following areas are to be covered under CSRD reporting requirements:

- Business model and strategy

- Corporate governance and use of sustainability experts

- Sustainability policy

- Due diligence

- Value chain information

- Impacts, risks, and opportunities

- Sustainability action plans, metrics, and targets

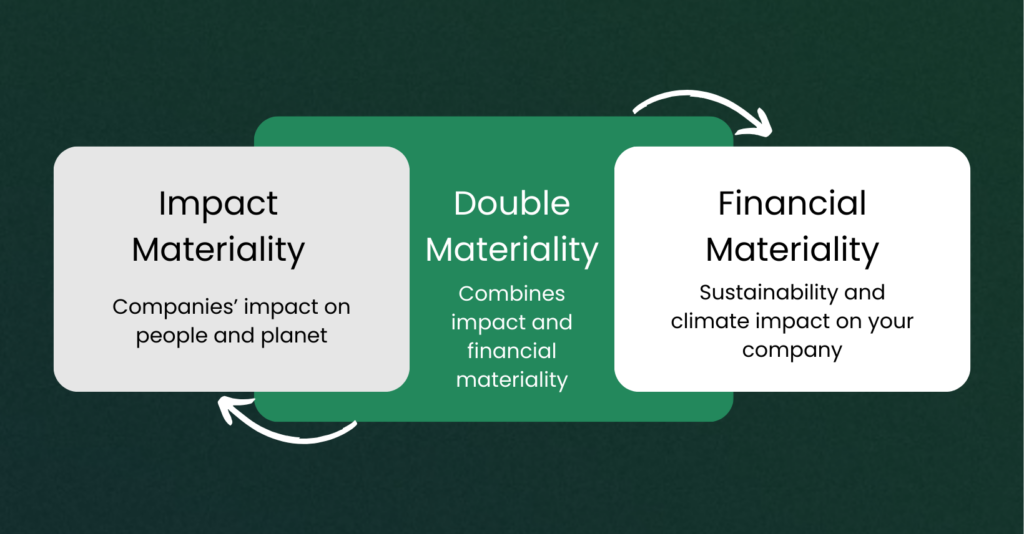

Double materiality

CSRD requires companies to disclose sustainability information under the double-materiality principle.

This approach mandates that organizations report on both their impact on ESG matters, as well as how these factors affect their sustainability performance.

In essence, companies must evaluate and communicate not only the effects they have on sustainability issues but also how these issues may present risks or opportunities to their business operations and financial standing.

In CSRD requirements, organizations must provide “information necessary to understand the undertaking’s impacts on sustainability matters, and information necessary to understand how sustainability matters affect the undertaking’s development, performance and position.”

Noncompliance penalties

CSRD will apply to sustainability practices across operations, and organizations must have their reports audited by accredited third parties.

Companies required by the CSRD to report must meet these standards or face consequences.

CSRD mandates strict compliance, with significant penalties for non-compliance.

Companies will face varying consequences depending on the jurisdiction and the severity of the violation.

For example, France has adopted strict penalties, such as:

- Up to €18,750 for not publishing the sustainability report

- Up to €100,000 for obstructing external auditor’s work or not providing necessary information

- Up to €375,000 and a maximum of 5 years in prison for the absence of assurance through accredited independent third party

Beyond penalties, companies that fail to meet CSRD requirements will risk limited access to financing, exclusion from public contracts, market access restrictions, and damaged reputation with stakeholders.

Transforming business through CSRD disclosure

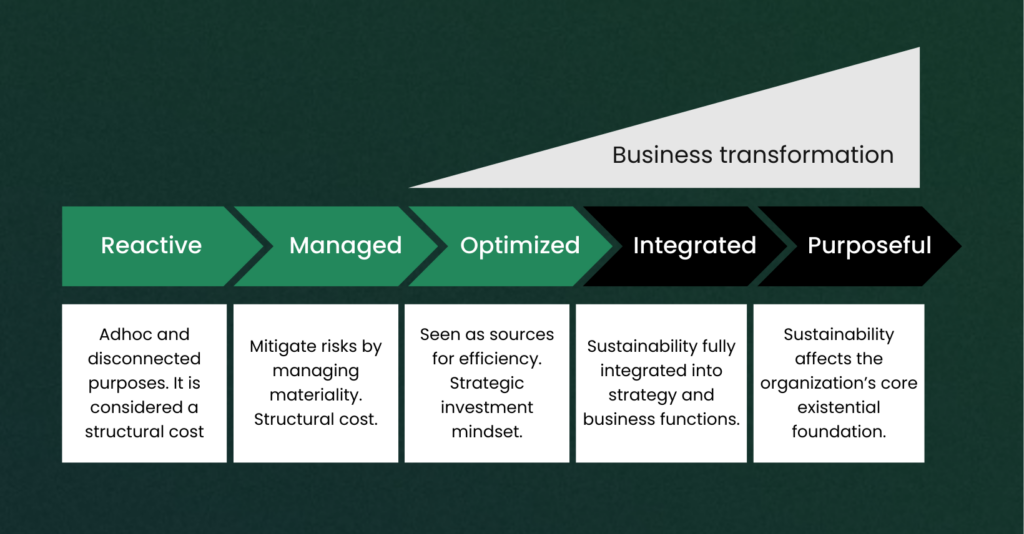

Businesses typically evolve along a maturity curve.

In this journey, sustainability is increasingly seen as a strategic commercial driver and is integrated across business functions. If managed carefully, CSRD will also accelerate business performance.

CSRD requires you to incorporate sustainability into financial information, as well as obtain a limited assurance level of data assurance on your material topics.

The process involves analysing risks and opportunities under a range of different scenarios and time horizons, and then attempting to quantify the potential financial and sustainability impact – both negative and positive ones that the business might face.

CSRD also allows you to see that climate risk and broader ESG matters or sustainability issues actually have a direct and material impact on your financials.

CSRD applies the integration of a financial lens to ESG and climate disclosure.

This will yield really important insights into your organization’s resilience, revenue streams, and reduce exposure to risks from the transition to low-carbon economies.