Performing carbon due diligence is not only good for the planet and the people living in it. It will also bring value to your business.

Before revealing how carbon reduction can generate new revenues for your organisation, let’s briefly look at what a triple bottom line is.

What’s a triple bottom line?

Besides safeguarding the Earth, your decisions should take into account the needs and demands of all your stakeholders (i.e., employees, investors, customers, local community).

Ditching carbon is the sustainable link among the three pillars of your climate-friendly framework. But giving priority to sustainability doesn’t come at the expense of your earnings. Quite the opposite indeed.

Let’s find out how…

Saving the planet and money

Our planet should be the top-priority component of any business’ triple bottom line. If you’ve already committed to net-zero targets, you’re on the right track.

Everybody knows global warming is damaging the environment, but some business leaders may not be aware that climate change could negatively impact their financial balance too.

In 2020 alone, climate-induced calamities caused £156 billion worth of damage globally. And enterprises are also paying the price for it.

Out of the 750 executives surveyed by Deloitte at the beginning of 2021, about 30% of them reported their companies’ operations were already affected by climate-induced disruptions. On top of that, 1 in 4 firms are running out of primary resources, with energy and consumer sectors being the most impacted.

Cutting down your carbon emissions is vital to future-proof your business and the whole world against natural disasters.

Sounds like a mission impossible?

That’s because you may not be using your climate mitigation superpowers.

But it’s not just about preventing costs.

Attracting eco-conscious people

When being mindful of the planet, your organisation is doing good for the whole society. Which leads us to the next point.

Putting carbon reduction at the core of your business, you’ll retain and win new eco-minded customers.

People are shifting their consumption behaviour as they become more and more greedy for low-carbon goods. Last October, Exasol interviewed 8,056 employees from companies across the world.

Based on their survey, two-third of interviewees won’t buy a thing from your firm until they see data-led evidence of your climate mitigation plans over the next 3 years. To add to that, 86% of participants already turned their backs to businesses that were not seriously involved in the struggle against climate change.

And it’s not just consumers demanding for decarbonisation. Investors are rewarding low-carbon companies as well.

Lazard examined the link between the equity value of and the GHG emitted by 16,000 global companies from 2016 to 2020. Analysts found that corporations’ price-to-earnings ratio fell with the increase in carbon emissions.

Largest (market cap above $50 billion) European industrial corporations paid for the highest climate discount. An 18% drop in their valuation for every 10% rise in their carbon footprint.

Clearly, it’s time to ditch your carbon to capitalise on this growing green market.

A market for carbon

Speaking of market…

So far, we’ve talked about abstract or passive income sources. But there’s a more tangible and active way you could profit from getting rid of your GHG emissions: Carbon pricing.

By putting a price tag on your carbon emissions, you’ll look at them as an economic burden. Ergo, you’ll have a financial driver to decarbonise your activity.

So, how does carbon pricing work?

You have two options: cap-and-trade, a.k.a. emissions trading system (ETS), or internal carbon pricing (ICP).

Cap-and-trade

Going for this option, you literally enter a carbon market.

Basically, you’ll get a yearly maximum carbon allowance (i.e., cap) from the government (it’s free to begin with). If you manage not to use up your emission quota, you can sell your spare carbon to other more polluting companies.

The result of this?

Making money while saving the planet and people. Just what you need for lifting up your triple bottom line.

ICP

In this case, you’re in charge of setting the carbon price. There are two major ICP mechanisms you can adopt: A carbon tax or a shadow price.

To understand its application, let’s take the fleet example. Perhaps today an electric vehicles (EVs) fleet may be more expensive than a diesel one. However, when considering the projected cost (i.e., shadow price) of diesel, renewable electricity could be the way to go.

Ready to get started?

Spearheading the low-carbon initiative could let you reap its financial benefits.

However, measuring and reducing your carbon footprint is essential to hit the eco-jackpot. And this isn’t an easy task if you don’t use the right tools.

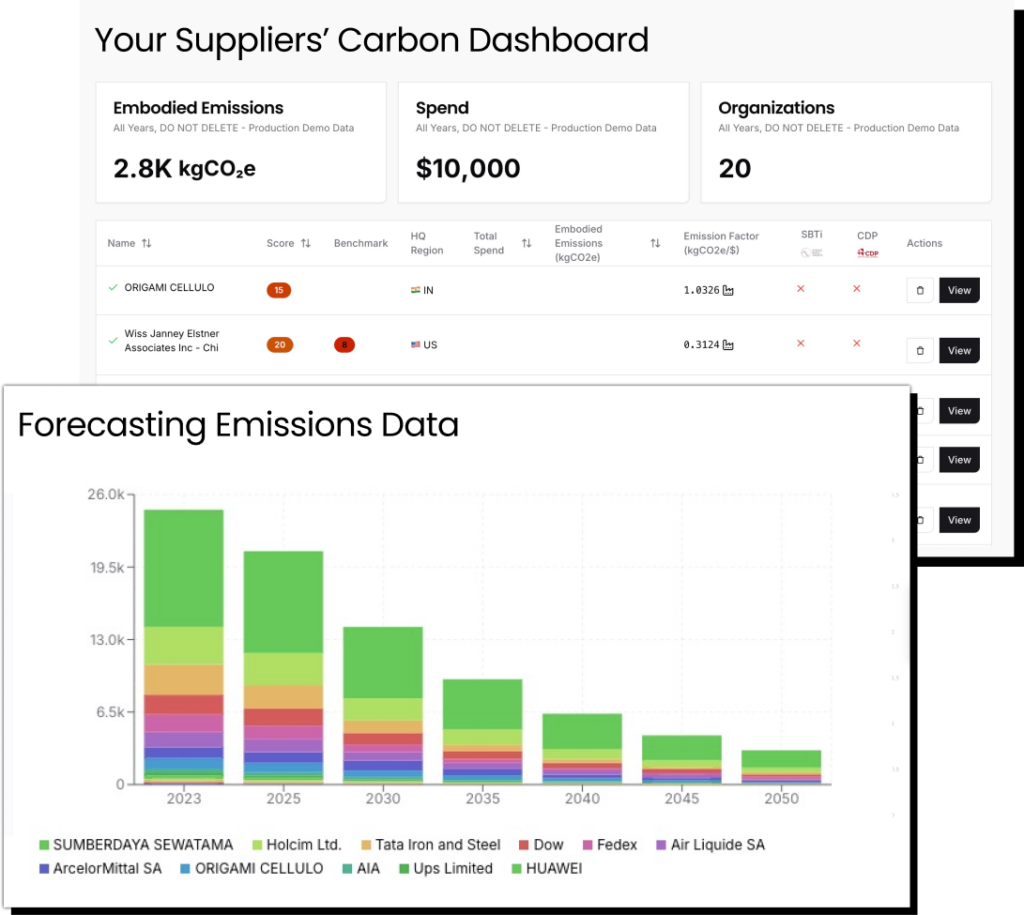

That’s why you should try out Ditch Carbon.

To join the climate fight, book a time to chat to us and we’ll help you get the carbon footprint of up to 250 suppliers totally free >>