This approach to climate reporting and making ethical changes can be helped when companies prioritise GRC.

But GRC and ESG, what exactly are they?

These acronyms go beyond being just buzzwords; they’re useful frameworks through which we can understand companies’ contribution to wider society.

So let’s jump into what exactly these terms mean and how they influence one another.

What is GRC?

GRC stands for governance, risk (risk management), and compliance. While companies have often factored some form of governance, risk, and compliance in business, GRC is a model that essentially combines all three.

The three components are typically defined as follows:

- Governance: Governance refers to the management of an organization by its leaders, who should work in accordance with approved strategies and an ethical approach. The corporate governance team of an organisation are responsible for decision making and creating company-wide initiatives.

- Risk: Risk (or risk management) refers to an organization’s approach to identifying, evaluating, and minimizing risks, whether at a financial or health and safety level.

- Compliance: Compliance refers to a company’s adheral to standards, regulations, and best practices mandated or recommended by governing bodies and legislation.

The GRC framework says that companies can better meet their goals when the departments and individuals responsible for governance, risk and compliance work together.

If properly implemented, a GRC capability model can reduce costs, improve leadership effectiveness, protect against financial penalties and litigation, and increase the visibility of vulnerabilities in the system – all good news for organisations.

What is ESG?

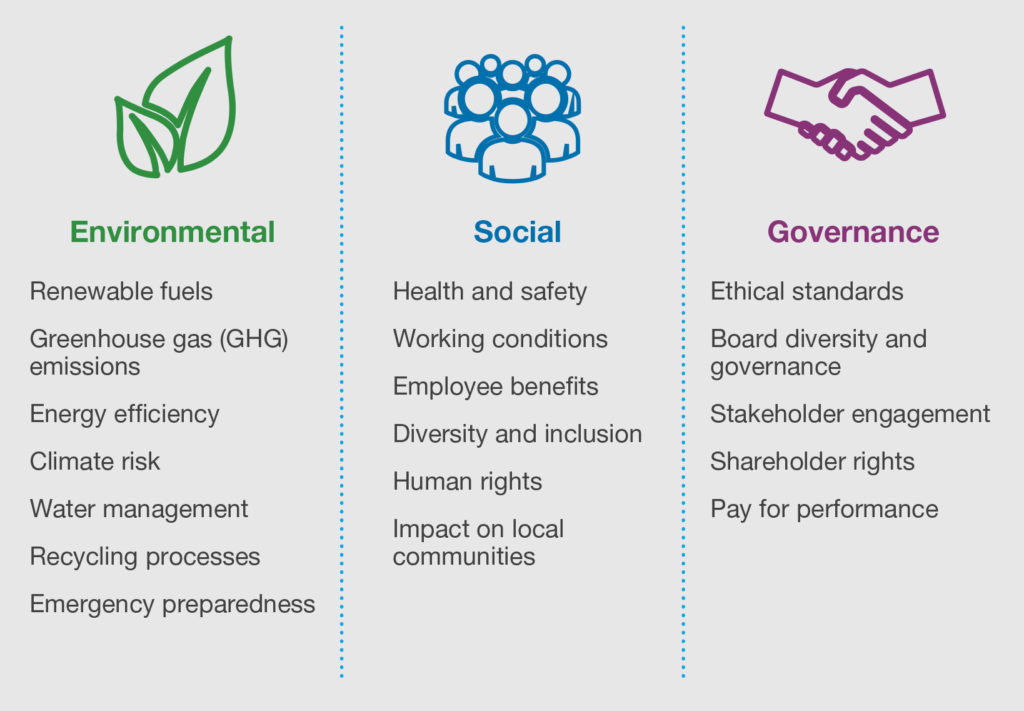

ESG stands for environment, social, and governance, and is part of CSR (corporate social responsibility). It’s a set of standards for measuring a business’s impact on society, the environment, and its transparency. A whopping 88% of publicly-traded companies have ESG initiatives in place, underlining their importance.

The three components are typically defined as follows:

- Environment: The environmental aspect focuses on how an organisation reduces its impact on the environment, using techniques such as swapping to renewable energy, reducing plastic use, and developing more sustainable products.

- Social: The social component refers to how a business impacts the wider community and society at large with its business practises.

- Governance: As in GRC, governance refers to the leaders at the top of the organisation and the role they play in decision-making and logistics.

Not only do ESG objectives benefit society at large, but they can also increase organisations’ successes, with two-thirds of investors taking ESG data into account when deciding which companies to invest in.

But what’s the role of GRC is developing an organisation’s ESG? Let’s dive in and find out.

How GRC improves ESG

When a company embarks upon an ESG strategy or ESG reporting in their organisation, engaging all the relevant stakeholders and achieving the desired results can be a challenge.

That’s where GRC processes come in. While GRC alone won’t help a company achieve its environmental goals, each component of a well-planned GRC strategy can support ESG.

Here’s how.

Governance and ESG

No initiatives can be properly established in a business without the support and approval of the leadership team. The purpose of a leadership team in this context is to set clearly defined objectives for the ESG programme.

Once the objectives are established, the leadership team can oversee their implementation and results.

Any organisation’s management is also responsible for company culture, which may have to change if a business wants to reach its ESG goals. Plus, they’ll need to establish who the stakeholders are and how their relationship to the organisation can support its objectives.

Risk and ESG

The move to becoming a more sustainable business can be challenging, and there may be barriers to an organisation’s process that come from within the organisation itself.

Taking a risk assessment approach to ESG is a great way to establish any threats to your company’s climate pledges.

Let’s say your organisation provides a service that requires internet connection. For this stable connection, you use electricity from fossil fuels.

If you want to switch to renewable energy, there’s a risk that using solar panels on the business premises will result in an inconsistent power supply, which would risk the success of your business.

An easy solution in this situation would be to purchase renewable energy from a reliable verified supplier. This is just one example of how assessing risks can help your journey to becoming more sustainable.

Compliance and ESG

Every successful sustainability project requires reporting standards. Companies that aren’t held accountable for their environmental and social impact are less likely to make meaningful changes, which is where compliance comes in.

Organisations can decide which metrics by which to judge their environmental work, or they can hire a third-party company to keep them accountable.

They can even make environmental pledges or add pledges into their business strategy, so stakeholders can encourage compliance. All companies should be regularly monitoring the latest environmental legislation anyway to confirm compliance.

Final Thoughts

GRC and ESG are more than just trendy terms; they’re frameworks companies can use to achieve sustainability goals. Through pursuing ESG through a GRC lens, organisations will find it easier to meet their climate goals, which makes the world a better place for all of us.